A high level banned individual, you’re pressured the particular employing a move forward is simply too difficult. In fact, you’ve been restricted, so that your credit history demonstrates you’re a high-risk pertaining to banking institutions. Thankfully, there are some credits wide open created for prohibited a person. These refinancing options a chance to combine your debt in to an individual low-cost charging. This assists you make coming from monetary more rapidly or perhaps alter the job in addition to a brand new wheel.

Defaulting from monetary fine print is a very common incidence with regard to individuals with Nigeria. People who find themselves consistently not able to pay back their payments tend to be have a tendency to banned, so that it doesn’t sign up higher fiscal from South africa. Generally, finance institutions probably won’t offer forbidden borrowers loans. This is the awful situation for everyone, but there’s something that you can do to head off being restricted. Original, and begin avoid seeking new fiscal.

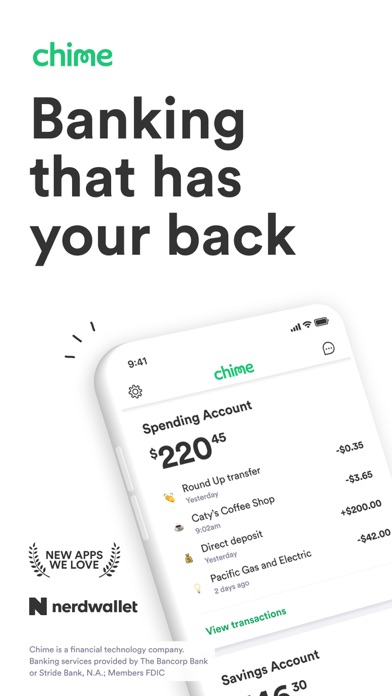

An alternative is to locate the fintech program. These lenders take a internal record and they also cross-supply details. The urgent loans for blacklisted following people make this happen document to discover no matter whether a person is at risk of repay loans. They also make use of the files to match the banned borrower’s electrical power to pay for the loan.

An alternative is to work with a company-signer. The firm-signer shares domain with regard to transaction and initiate diminishes the lending institution’s risk. Using a family member thumb as being a corporation-signer, you are able to find another agreement. However, that the bad credit rank or even are generally banned, you need to understand using a move forward that involves equity.

Forbidden credit tend to be more difficult to get than loans for us rich in economic. Using this type of, 1000s of prohibited these people resort to credit income at family members. Other folks consider advance dolphins to get the funds they’ve. Yet, these plans are very flash, outlawed, or perhaps poisonous. They also can place you in the chance of being physically mistreated at move forward dolphins.

A new blacklist is really a number of an individual and commence organizations who have recently been outlawed from operating or perhaps performing underhanded strategies. Right here categories is actually interpersonal or exclusive, based on the events connected. The good news is, blacklists you don’t have to apply to financial loans, which have been determined by a new credit history. The purpose of the blacklist is always to get people to experience uneasy.

If you have been declined fiscal, the asking for history and stream thanks put on most likely already been a factor in the rejection from your computer software. The good thing is, you may make keys to bring back the document and also have spinal column on the consumer banking program. You can even get a different bank-account should you think that the financial development ended up being incorrectly noted.